October!

JYang, Oct 31 2008

i barely have time to play poker anymore. school is killing a ton of time. next week is my last midterm so hopefully i can start gettin some decent # of hands in.

my stock profolio is up over 100% this month. w00t? good to be on the side of the trend. which i think is up.. right now. pretty much caught a lot of movements this month. i think in the short term we'll be going up a lot. this is a good temporary bottom for now. was also reading some newsletters the other day and from the general perspective, short term is like 1 year.. lol wtf. i wont have the patience to hold it for that long to see if my positions work out or not.

basically im lookin for some cool retracements nowadays since i think we're goin to be in a uptrend these few months.

basically it was valued at like $180 few months ago and went on a freefall, its gonna bounce back since the direction of the trend has changed. stuff that cant really be explained but just work magically to give odds. graph of US Steel is below

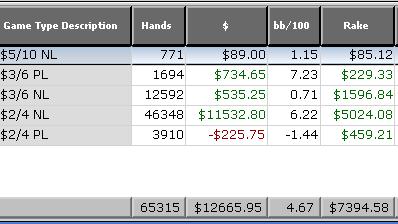

obv also played some poker

this is the least amount of hands i played in like since i ever started playin real money. that's how bad my motivation is for poker right now. i also blame school.

other than that i dont have any real tracking stuff for my stocks since my discount broker zecco charges $ to view ur performance. im up ~9000$ this month from a $8800 profolio. so thats good

add 5555$ from poker, 1050$ from rakeback. still ballin ^_^

on track for a 200k$ midstaker year

gl all, hope u all run good

right now im holding X (us steel) going long.

wtf solar calculators

JYang, Oct 26 2008

so i have a solar calculator

specifically the texas instrument BA-35 solar

it doesn't turn on now

havent used it in a while

how do i fix these things?

EDIT: NVM FIXED

I found the on button

there was a retarded σn button that looks exactly like it

and it auto turns on with bright light

any products that....

JYang, Oct 19 2008

keep ur fingers + hand warm while letting u type and control mouse good?

so far i found usb heated gloves made from china but the reviews say they give u some shocks

real cause of financial crisis

JYang, Oct 19 2008

http://news.yahoo.com/s/afp/20081018/wl_afp/euimmigration

nope its not the short sellers anymore, they only account for around 3% of total stock market volume..

its the god damn immigrants again

Interesting News

JYang, Oct 18 2008

Came back from school and read some news, came across this. Basically a hedge fund manager's letter of goodbye explaining how messed up this country is, the system and the laws. something different from all the financial mess we all been hearing.

http://ftalphaville.ft.com/blog/2008/10/17/17194/andrew-lahde-bows-out-in-style/

Say what you will about Andrew Lahde, but the man knows how to write a letter.

Last month, the famed-for-betting-against-subprime hedge fund manager shuttered his operations, citing unacceptable levels of counterparty risk.

His goodbye missive is impressive not just for its length, but for its clearly-articulated (and somewhat apocalyptic) closing arguments.

Verbatim:

“Today I write not to gloat. Given the pain that nearly everyone is experiencing, that would be entirely inappropriate. Nor am I writing to make further predictions, as most of my forecasts in previous letters have unfolded or are in the process of unfolding. Instead, I am writing to say goodbye.

Recently, on the front page of Section C of the Wall Street Journal, a hedge fund manager who was also closing up shop (a $300 million fund), was quoted as saying, “What I have learned about the hedge fund business is that I hate it.” I could not agree more with that statement. I was in this game for the money. The low hanging fruit, i.e. idiots whose parents paid for prep school, Yale, and then the Harvard MBA, was there for the taking. These people who were (often) truly not worthy of the education they received (or supposedly received) rose to the top of companies such as AIG, Bear Stearns and Lehman Brothers and all levels of our government. All of this behavior supporting the Aristocracy, only ended up making it easier for me to find people stupid enough to take the other side of my trades. God bless America.

There are far too many people for me to sincerely thank for my success. However, I do not want to sound like a Hollywood actor accepting an award. The money was reward enough. Furthermore, the endless list those deserving thanks know who they are.

I will no longer manage money for other people or institutions. I have enough of my own wealth to manage. Some people, who think they have arrived at a reasonable estimate of my net worth, might be surprised that I would call it quits with such a small war chest. That is fine; I am content with my rewards. Moreover, I will let others try to amass nine, ten or eleven figure net worths. Meanwhile, their lives suck. Appointments back to back, booked solid for the next three months, they look forward to their two week vacation in January during which they will likely be glued to their Blackberries or other such devices. What is the point? They will all be forgotten in fifty years anyway. Steve Balmer, Steven Cohen, and Larry Ellison will all be forgotten. I do not understand the legacy thing. Nearly everyone will be forgotten. Give up on leaving your mark. Throw the Blackberry away and enjoy life.

So this is it. With all due respect, I am dropping out. Please do not expect any type of reply to emails or voicemails within normal time frames or at all. Andy Springer and his company will be handling the dissolution of the fund. And don’t worry about my employees, they were always employed by Mr. Springer’s company and only one (who has been well-rewarded) will lose his job.

I have no interest in any deals in which anyone would like me to participate. I truly do not have a strong opinion about any market right now, other than to say that things will continue to get worse for some time, probably years. I am content sitting on the sidelines and waiting. After all, sitting and waiting is how we made money from the subprime debacle. I now have time to repair my health, which was destroyed by the stress I layered onto myself over the past two years, as well as my entire life — where I had to compete for spaces in universities and graduate schools, jobs and assets under management — with those who had all the advantages (rich parents) that I did not. May meritocracy be part of a new form of government, which needs to be established.

On the issue of the U.S. Government, I would like to make a modest proposal. First, I point out the obvious flaws, whereby legislation was repeatedly brought forth to Congress over the past eight years, which would have reigned in the predatory lending practices of now mostly defunct institutions. These institutions regularly filled the coffers of both parties in return for voting down all of this legislation designed to protect the common citizen. This is an outrage, yet no one seems to know or care about it. Since Thomas Jefferson and Adam Smith passed, I would argue that there has been a dearth of worthy philosophers in this country, at least ones focused on improving government. Capitalism worked for two hundred years, but times change, and systems become corrupt. George Soros, a man of staggering wealth, has stated that he would like to be remembered as a philosopher. My suggestion is that this great man start and sponsor a forum for great minds to come together to create a new system of government that truly represents the common man’s interest, while at the same time creating rewards great enough to attract the best and brightest minds to serve in government roles without having to rely on corruption to further their interests or lifestyles. This forum could be similar to the one used to create the operating system, Linux, which competes with Microsoft’s near monopoly. I believe there is an answer, but for now the system is clearly broken.

Lastly, while I still have an audience, I would like to bring attention to an alternative food and energy source. You won’t see it included in BP’s, “Feel good. We are working on sustainable solutions,” television commercials, nor is it mentioned in ADM’s similar commercials. But hemp has been used for at least 5,000 years for cloth and food, as well as just about everything that is produced from petroleum products. Hemp is not marijuana and vice versa. Hemp is the male plant and it grows like a weed, hence the slang term. The original American flag was made of hemp fiber and our Constitution was printed on paper made of hemp. It was used as recently as World War II by the U.S. Government, and then promptly made illegal after the war was won. At a time when rhetoric is flying about becoming more self-sufficient in terms of energy, why is it illegal to grow this plant in this country? Ah, the female. The evil female plant — marijuana. It gets you high, it makes you laugh, it does not produce a hangover. Unlike alcohol, it does not result in bar fights or wife beating. So, why is this innocuous plant illegal? Is it a gateway drug? No, that would be alcohol, which is so heavily advertised in this country. My only conclusion as to why it is illegal, is that Corporate America, which owns Congress, would rather sell you Paxil, Zoloft, Xanax and other additive drugs, than allow you to grow a plant in your home without some of the profits going into their coffers. This policy is ludicrous. It has surely contributed to our dependency on foreign energy sources. Our policies have other countries literally laughing at our stupidity, most notably Canada, as well as several European nations (both Eastern and Western). You would not know this by paying attention to U.S. media sources though, as they tend not to elaborate on who is laughing at the United States this week. Please people, let’s stop the rhetoric and start thinking about how we can truly become self-sufficient.

With that I say good-bye and good luck.

All the best,

Andrew Lahde”

going bulllish

JYang, Oct 17 2008

damn i overslept this morning and didnt get the best price

i knew i was going long today... oh well

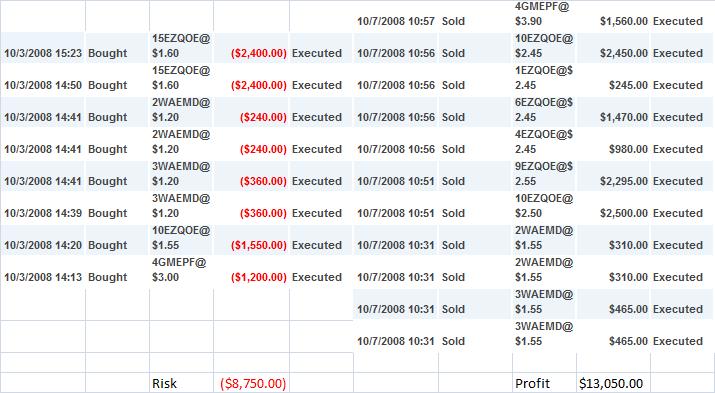

my positions for today (just entered it in few minutes ago)

i realllly hope the market doesn't go crazy this time and i can hold my shits a bit longer.

im trading mostly small caps and they are pretty damn illiquid. i get raped by the big/ask slippage.

basically the reason for this trade is that i'm just lookin for a retracement, like the S&P is down ~40% and im just looking for it to bounce up again. the pattern is a double bottom and many would say that this is pretty good tradeable mini bottom. gettin good pot odds for my $ so why not.

as for guys who'd like to get started... just gonna point u out to few books

http://forumserver.twoplustwo.com/30/...ng/my-guide-day-trading-v1-0-a-75338/

1. obvious the bible of technical analysis, Technical Analysis of the Financial Markets

http://thepiratebay.org/torrent/33924...Analysis_Of_The_Financial_Markets.pdf

that 2+2 thread was a day trading guide but obv u just gotta read few books and see which method of trading is right for you. so i guess just read a lot. i don't day trade but that guide was very helpful. the books he recommended was really really good.

will post more books in the future

stock market

JYang, Oct 15 2008

stocks are the cool things to talk about these days so i'll add my words

this stuff is bad and getting worst

in general how people interpret the morning/closing action is like morning the amateurs will get their trades in, and then the later hours are all dictated by the pros. seems like every time there's a gap in the morning, it usually goes lower. kinda like how public is getting fucked. no clue when they'll lose their confidence but i guess that's a possible indicator where academically educated people give up hope.

but i read somewhere (i forgot where), cuz i been readin a ton, that many stock broker accounts are having cash reserves ready to buy stocks. people like to pick bottoms i guess. and i guess reason for it is that all the retarded stock market books all praise warren buffett and buy and hold for 7% zomg. and that stock market is efficient and buy and hold is correct strategy (actually taught in schools wtf).

i exited all my holdings yesterday because i have no idea where this shit is going. and today it went down, woot lucky i exited.

stuff to look for tommorow:

1. will the greedy amateurs who missed a chance for the 11% jump come back in and push it for a few more days? if yes im prolly switchin back to a 100% short position since our crisis is still so bad than what the news is saying.

2. i think we'll see a bounce at the 800 point level in the S&P since its like our last support level.

3. i think its time to short.

some thoughts and ideas

1. i'll pick up shares of blizzard in the future, not now b/c i still think the market is pricey

2. avg s&p p/e level is still ~15. not that p/e really mean much. but many people still believe in it.

3. stocks are cool

some interestin ideas....

this shit really looks that Japan in the 1990 bubbles and ima quote straight from wikipedia

http://en.wikipedia.org/wiki/Deflation#Deflation_in_Japan

Deflation started in the early 1990s. The Bank of Japan and the government have tried to eliminate it by reducing interest rates (part of their 'quantitative easing' policy), but this was unsuccessful for over a decade. In July 2006, the zero-rate policy was ended, and by 2008 Japan was again sustaining positive inflation rates.

Systemic reasons for deflation in Japan can be said to include:

Fallen asset prices. There was a rather large price bubble in both equities and real estate in Japan in the 1980s (peaking in late 1989). When assets decrease in value, the money supply shrinks, which is deflationary.

Insolvent companies: Banks lent to companies and individuals that invested in real estate. When real estate values dropped, these loans could not be paid. The banks could try to collect on the collateral (land), but this wouldn't pay off the loan. Banks have delayed that decision, hoping asset prices would improve. These delays were allowed by national banking regulators. Some banks make even more loans to these companies that are used to service the debt they already have. This continuing process is known as maintaining an "unrealized loss", and until the assets are completely revalued and/or sold off (and the loss realized), it will continue to be a deflationary force in the economy. Improving bankruptcy law, land transfer law, and tax law have been suggested (by The Economist) as methods to speed this process and thus end the deflation.

Insolvent banks: Banks with a larger percentage of their loans which are "non-performing", that is to say, they are not receiving payments on them, but have not yet written them off, cannot lend more money; they must increase their cash reserves to cover the bad loans.

Fear of insolvent banks: Japanese people are afraid that banks will collapse so they prefer to buy gold or (United States or Japanese) Treasury bonds instead of saving their money in a bank account. This likewise means the money is not available for lending and therefore economic growth. This means that the savings rate depresses consumption, but does not appear in the economy in an efficient form to spur new investment. People also save by owning real estate, further slowing growth, since it inflates land prices.

Imported deflation: Japan imports Chinese and other countries' inexpensive consumable goods, raw materials (due to lower wages and fast growth in those countries). Thus, prices of imported products are decreasing. Domestic producers must match these prices in order to remain competitive. This decreases prices for many things in the economy, and thus is deflationary.

---------------------

whats different this time?

dollar's actually rising

stuff to look for:

asians as we know like to save. but americans like to spend. so will americans keep spending? or will they start saving? if this is true then like we can just short everything cuz its the repeat of japan.

oh yea i also wanna add that we didnt care back then in japan cuz it was only like a small island in the middle of nowhere. but here in the USA we diversity risk globally and we're getting help too.

will these factors help? or will this be a repeat of history?

runnning good

JYang, Oct 13 2008

so i stopped playing poker and start trading stocks. so far been running pretty good. still reading lots of materials trying to improve but since im pretty bored i started active trading anyway. so far been running pretty good.

that was when the Fed announced a 700B bailout. i was extremely bearish and betting a lot on high flyin growth cyclical consumer stocks will go down. turns out that it worked but i got rid of it pretty fast, but i cant complain on a 4300$ profit. i was gettin abit bullish as the stocks seem to be at a extremely oversold level

my current positions, surprisingly it closed at exactly 13.37$

im 100% long this week

----------

probably making this my trading blog. since a lot of other traders have blogs. im pretty new and been reading a ton. i stopped playin poker  . .

its like the times when i feel that i cant wait to see the market open and how my strategy is working out.

so far i been a pretty big luckbox but i'll keep this updated.

i'm trading on a 5 day time frame i dont think buy and hold is any good at all. im really bullish this week but long term im still very bearish.

----

more: i guess i'll provide links to people who would like to at least learn a bit about this. (coming soon)

-im not really qualified to write anything, and ppl prolly dont want to read any educational thing i write anyway.

-i guess i'll link stuff that i find interesting and cool.

-probably goin to upload some good trading books to rapidshare...

zomg update

JYang, Oct 05 2008

i havent played a single hand in like ~18 days. which is a lot for me since im usually a very high volume player.

been really busy with school and midterms and i wanted to go trading instead, so that pretty much kills all my poker time.

my outlook for the economy is that it will be worst than what u see on the news. the news actually, still believes that the economy is fine and will slowly rebuild (ya, maybe like in 15+ yrs). look at how the market reacted to the bailout bill. the anticipation of the bill caused stocks to rise and when it actually passed it fell to the red. my profolio is all put positions and shorts. I hope the market crashes on monday, ^_^.

im having tons of liquidity problems too. i can't cash out because of tax reasons. im heavily leveraged anyway.

im actually keeping up with the world now. and seeing more gigantic luckboxes along the way in the market. like... Abby Joseph Cohen, she was like the senior US investment strategiest and named one of the 30 most powerful woemn in america. her investment philosophy is that the market does nothing but go up.. everyday, every month, every year.... no matter how fucked up the economy is, she's always bullish. good thing she got replaced at goldman sachs.

its really stuff that makes u think WTF RU SRS

my results for september was decent altho i ran really bad at higher stakes.

my eyes are tired help

JYang, Sep 09 2008

first time in my life this has happened

my eyes are tired every time i stare at the pc. even when i just woke up from resting

anyone suggestions?

Previous Page Next Page |

Contact Users: 934 Active, 0 Logged in - Time: 14:51

Contact Users: 934 Active, 0 Logged in - Time: 14:51