|

|

|

Reagan Did It |

|

1

|

TenBagger United States. Jun 03 2009 11:32. Posts 2018 | | |

Op-Ed column from the NYTimes by Paul Krugman. This one is for you ToTehEastSide:

“This bill is the most important legislation for financial institutions in the last 50 years. It provides a long-term solution for troubled thrift institutions. ... All in all, I think we hit the jackpot.” So declared Ronald Reagan in 1982, as he signed the Garn-St. Germain Depository Institutions Act.

He was, as it happened, wrong about solving the problems of the thrifts. On the contrary, the bill turned the modest-sized troubles of savings-and-loan institutions into an utter catastrophe. But he was right about the legislation’s significance. And as for that jackpot — well, it finally came more than 25 years later, in the form of the worst economic crisis since the Great Depression.

For the more one looks into the origins of the current disaster, the clearer it becomes that the key wrong turn — the turn that made crisis inevitable — took place in the early 1980s, during the Reagan years.

Attacks on Reaganomics usually focus on rising inequality and fiscal irresponsibility. Indeed, Reagan ushered in an era in which a small minority grew vastly rich, while working families saw only meager gains. He also broke with longstanding rules of fiscal prudence.

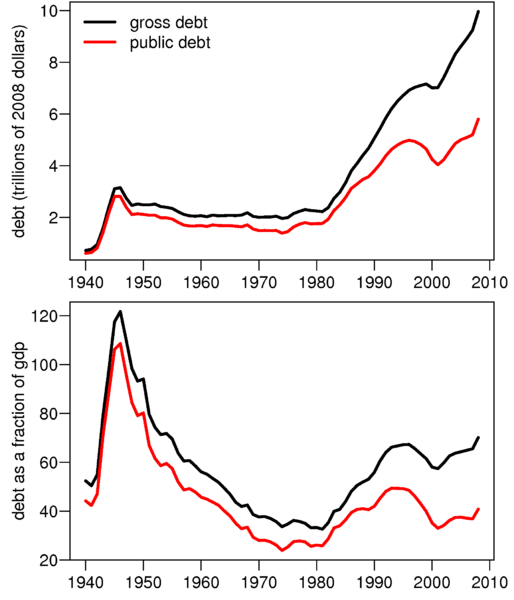

On the latter point: traditionally, the U.S. government ran significant budget deficits only in times of war or economic emergency. Federal debt as a percentage of G.D.P. fell steadily from the end of World War II until 1980. But indebtedness began rising under Reagan; it fell again in the Clinton years, but resumed its rise under the Bush administration, leaving us ill prepared for the emergency now upon us.

The increase in public debt was, however, dwarfed by the rise in private debt, made possible by financial deregulation. The change in America’s financial rules was Reagan’s biggest legacy. And it’s the gift that keeps on taking.

The immediate effect of Garn-St. Germain, as I said, was to turn the thrifts from a problem into a catastrophe. The S.& L. crisis has been written out of the Reagan hagiography, but the fact is that deregulation in effect gave the industry — whose deposits were federally insured — a license to gamble with taxpayers’ money, at best, or simply to loot it, at worst. By the time the government closed the books on the affair, taxpayers had lost $130 billion, back when that was a lot of money.

But there was also a longer-term effect. Reagan-era legislative changes essentially ended New Deal restrictions on mortgage lending — restrictions that, in particular, limited the ability of families to buy homes without putting a significant amount of money down.

These restrictions were put in place in the 1930s by political leaders who had just experienced a terrible financial crisis, and were trying to prevent another. But by 1980 the memory of the Depression had faded. Government, declared Reagan, is the problem, not the solution; the magic of the marketplace must be set free. And so the precautionary rules were scrapped.

Together with looser lending standards for other kinds of consumer credit, this led to a radical change in American behavior.

We weren’t always a nation of big debts and low savings: in the 1970s Americans saved almost 10 percent of their income, slightly more than in the 1960s. It was only after the Reagan deregulation that thrift gradually disappeared from the American way of life, culminating in the near-zero savings rate that prevailed on the eve of the great crisis. Household debt was only 60 percent of income when Reagan took office, about the same as it was during the Kennedy administration. By 2007 it was up to 119 percent.

All this, we were assured, was a good thing: sure, Americans were piling up debt, and they weren’t putting aside any of their income, but their finances looked fine once you took into account the rising values of their houses and their stock portfolios. Oops.

Now, the proximate causes of today’s economic crisis lie in events that took place long after Reagan left office — in the global savings glut created by surpluses in China and elsewhere, and in the giant housing bubble that savings glut helped inflate.

But it was the explosion of debt over the previous quarter-century that made the U.S. economy so vulnerable. Overstretched borrowers were bound to start defaulting in large numbers once the housing bubble burst and unemployment began to rise.

These defaults in turn wreaked havoc with a financial system that — also mainly thanks to Reagan-era deregulation — took on too much risk with too little capital.

There’s plenty of blame to go around these days. But the prime villains behind the mess we’re in were Reagan and his circle of advisers — men who forgot the lessons of America’s last great financial crisis, and condemned the rest of us to repeat it.

|

|

| 0

|

TheTank United States. Jun 03 2009 12:57. Posts 830 | | |

tl;dr, but ironically i am going to read the hell out of that derek jeter post below this b/c i am the baseball jesus and <3 bill james. prepare to get a pm response. |

|

| sigh...its like they are throwing money out of a helicopter and i dont have any hands...so i just break even. | |

|

| 1

|

SakiSaki  Sweden. Jun 03 2009 12:59. Posts 9687 Sweden. Jun 03 2009 12:59. Posts 9687 | | | |

|

| what wackass site is this nigga? | |

|

| 1

|

matdon460 United States. Jun 03 2009 13:06. Posts 1089 | | |

haha, read this yesterday in the paper. also reading Liar's Poker right now. Seems like the 80s was an awesome time for ibanks at the expense of mostly everyone else. |

|

| Of course it was a good shove, I won | |

|

| 1

|

luddite United States. Jun 03 2009 13:26. Posts 398 | | |

Yeah, I hate the fact that Reaganion is practically worshipped as a god by a huge portion of this country. Can't wait for more people to start to realize what a fuck-up he was as president. |

|

| 1

|

curtinsea United States. Jun 03 2009 14:17. Posts 576 | | |

and do you think the borrowing that Obama is doing is ok? it dwarfs anything ever seen before in the history of the US.It won't fix it anymore than it has in the past, and giving the current administration a pass by blaming it on 25 years ago is weak. |

| |

|

| 1

|

curtinsea United States. Jun 03 2009 14:31. Posts 576 | | |

since 1960, years the US did not run a deficit . . .

1969, 1998-2001. Also, during the 'Clinton years', the only talk of balancing the budget was done by the GOP, and it was a rebellion against Clinton's reckless spending plans that ushered in the GOP control of congress. Giving the president credit or blame for borrowing and spending isn't right, because congress controls the purse.

That said, the GOP right now has it's collective head up it's ass, and I don't identify myself as a republican out loud very often. Tit whining over what the Obama people are doing at this point is pointless, because his approval is too high for complaining or pointing out mistakes to have any effect other than making the GOP look like cry babies. I think they should just shut up for the next ten months and let things unfold. If it goes bad, they can make a case to try to get congress back, the way they did in '94. The problem is they haven't got a visionary like Newt to lead them. But, I think he is actually going to be the GOP candidate in 2012, and that will likely unfold beginning in January of next year.

so right now I am giving things a chance, not complaining too much and just see if Obama can hang himself if given enough rope.

Lastly, an OP-ED from the NY Times is nothing but leftist propoganda, whether it's accurate or not. It's not genuine news or anything remotely resembling journalism.

|

| |

|

| 1

|

TenBagger United States. Jun 03 2009 14:58. Posts 2018 | | |

I guess fox news is the "real" journalism.

this is my blog and I welcome intelligent debate. however, ignorance will be met with a swift ban. I don't care to see this blog post turn into the countless other threads that degenerated into worthless arguments.

I really have no energy left over to offer a rebuttal to your numerous misguided facts since I've learned that it is an utter waste of time. The central point of this op-ed piece was about how Reagen's deregulation of financial institutions lead to reckless behavior by those very same financial institutions, and the easy credit that followed led to a decline in savings rate and a rise in household debt. The result was the S+L fiasco in the 80's and set the stage for the global meltdown of last year.

If the republicans on this forum can disagree by providing intelligent arguments and stay on topic, healthy debate will be welcomed. However, going off course into a diatribe about how the most read and respected paper in the world is not "anything remotely resembling journalism" and dismissing a nobel prize winning economist's op-ed as nothing but leftist propoganda will be met with a swift ban. |

|

| 1

|

TenBagger United States. Jun 03 2009 15:15. Posts 2018 | | |

I'll give in here and make a rebuttal to the one concrete point that you made since it is the second time you've made this point on my blog and I never answered it last time. You claim that the Gingrich led GOP was the driving force behind fiscal responsibility. you said that:

"since 1960, years the US did not run a deficit . . .

1969, 1998-2001. "

that makes it seem like the US has always had a stable level of budget deficits. Well, here are the facts:

The important figure is the second graph that shows US Budget deficit as a percentage of GDP. The spike between 1940-1950 is obviously due to war, but other than that, there are few obvious trends. The debt as a ratio of GDP fell consistently from after the war era until 1980 which ironically is when Reagan took office. The debt then spiked up huge throughout his presidency and into the early 90's. It then fell again during the Clinton era until W. Bush got elected. W. Bush then got rid of paygo ( http://en.wikipedia.org/wiki/PAYGO ) and combined it with war and a tax cut (mainly for corps and the wealthy) which resulted in the second postwar period where budget deficits shot up. The facts clearly show that budget deficits as a percentage of GDP went down during the years where democrats held the white house and shot up astronomically during the reagan and bush administrations.

|

|

| | Last edit: 03/06/2009 15:23 |

|

| 1

|

NewbSaibot United States. Jun 03 2009 15:22. Posts 4946 | | |

Republicans right now are gambling on the failure of this country in order to survive as a political party. They know that if the democrats turn this mess around, and secure a system of government which proves more stable and reliable for future generations that their party will be finished forever. No one will ever vote republican again. But there is also the possibility that the mess they have made is simply too great for democrats to fix, but the onus is on us now. If the democrats indeed fail to solve our economic crisis' or come through with any promises to keep this nation in global leadership, the republicans can sit back and pretend they saw it all coming, pointing at all the rhetoric they spouted years before Obama's presidency is over. So basically, they are banking on the US's failure in order to sustain their party for the next election, even though they had nothing to do with foreseeing this. |

| |

|

| 1

|

YoMeR United States. Jun 03 2009 16:02. Posts 12438 | | |

i got one thing to say.

yo. fuck our lives. |

| |

|

| 1

|

curtinsea United States. Jun 03 2009 17:34. Posts 576 | | |

I was just commenting on your blog man, sorry if I offended you. But that piece is clearly laying blame for the mess on Reagan. It's done so to justify the insane spending going on right now, and serves no real purpose beyond that. Even if I agreed with it completely, it doesn't change anything in the present. It's moot.

And it was hardly a diatribe against the NYTimes. But an op-ed piece in a liberal paper is just that, an opinion from the left. be real.

I don't promote FOX news as a journalism source any more than I do MSNBC. Those are cable shows who get ratings by driving controversy.

Anyone can get an almanac, the numbers are all there. Our government spends, more than it takes in, more often than not, regardless of who has the checkbook at the moment. We argue over semantics.

|

| |

|

| |

|

|

Poker Streams | |

|

Contact Users: 273 Active, 0 Logged in - Time: 10:54

Contact Users: 273 Active, 0 Logged in - Time: 10:54