|

|

|

GameStop WallStreet scandal. - Page 4 |

|

4 1 4 1 1 1 1 1 0 1 1 4 4 4 1 1 1 1 1 0

|

Baalim Mexico. Feb 01 2021 09:50. Posts 34286 | | |

| | On February 01 2021 03:20 Santafairy wrote:

Show nested quote +

On February 01 2021 01:40 Baalim wrote:

| | On January 29 2021 09:31 Santafairy wrote:

people are trying to buy the stock at the listed value

if people are buying the stock they shouldn't need to post anything more than the stock's value in collateral, which is from actual money in the accounts of the small traders that use their service so why wouldn't they have that money right? that is an excuse... even ftp had more money on hand...

>a million people deposit $200 into FTP

>howard lederer deposits $100 million

>play $1/$2 with howard lederer

>"Due to the volatility of Howard Lederer's play, we are temporarily suspending winning pots vs him. You can only lose pots and fold your hand."

well this makes sense, if i play a pot with howard lederer ftp has to have the money after all... |

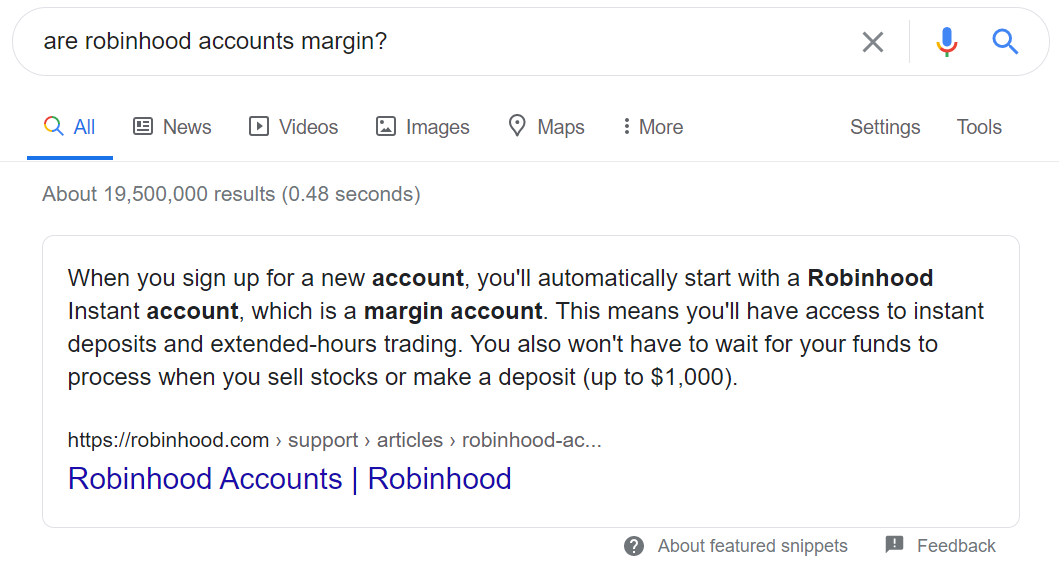

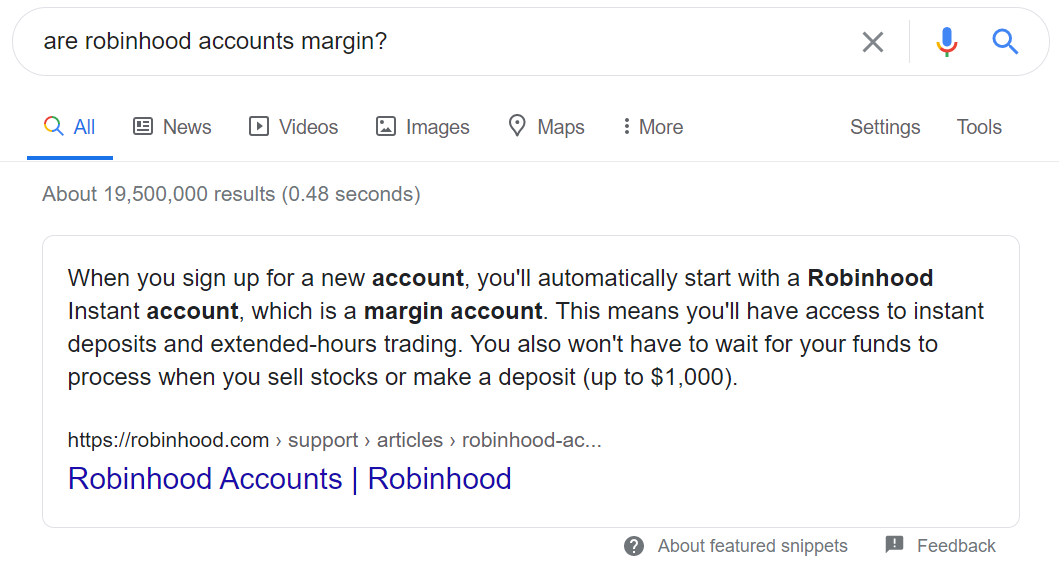

Robinhood's accounts are margin and not cash, I don't know the reason for this but these account require a Dodd-Frank mandated collateral that Robinhood did not have in their books so they were forced to close this.

I could be very well by design, or not. but the new york stock exchange along with Nasdaq were talking about closing trading the stock so, if you think me saying this somehow makes me a wallstreet apologist or something of the sort like the idiot RikD does then you'd be mistaken, I'm pretty aware that they are trying to stop the losses in very shitty ways and I'm very happy of seeing them bleed, in fact I want them to bleed much more.

|

I literally just read the opposite that half were cash accounts

But it may have been another platform |

Nope RobinHoods accounts are margin and the buy/sells are finalized 48h after, they aren't a stock exchange they are a broker but they dont execute the trades themselves, they also don't charge a fee for the trade, they make a profit by sharing the trade flow with Citadel.

Chamath Palihapitiya came down after Robinhood to promote SoFi which is owns, but it also does the exact same thing RH does with these free trades that just sell the info.

|

|

| Ex-PokerStars Team Pro Online | |

|

|

|

Spitfiree Bulgaria. Feb 01 2021 09:51. Posts 9634 | | |

This week we're going to see a lot of people lose a lot of money that they can't afford to. Hopefully, Melvin goes down with them

How the fuck is an app like Robinhood legal in that case? |

|

| | Last edit: 01/02/2021 10:04 |

|

|

|

Baalim Mexico. Feb 01 2021 10:14. Posts 34286 | | |

| | On February 01 2021 03:52 RiKD wrote:

Show nested quote +

Apparently Robinhood blocking trading with GME was because Dodd-Frank regulations require them to post collateral since the money is settled 48h after the trades.??The collateral ammount is calculated through the greek indicators, so if a stock has a 99% of staying within certain margin they post a collateral multiplied by that 1%, but now the volume and the volatility were greatly increased so basically Robinhood would have had to post like 10% of collateral for every buy on GME by law, so they stopped the buys from it.??So it appears that this block isn't as machiavellian as it seemed before, but its still a big hit on wallstreet cred. |

If you have a source/sources for this I am perfectly happy to eat shit, etc.

|

All the investors I follow mentioned that thing about at some point, Chamath, Balajis and also the one you mentioned, Alex Wice look at their twitter for the info if you want.

Margin accounts need insurance, insurances require you to have collateral dictated by Dodd-Frank regulation, in fact also Nassim Taleb mocked the methodology (VaR) to dictate this collateral requirement.

| | Why didn't the Chairman of Interactive Brokers or the CEO of Robinhood spin that information in a positive way when they went on their big tv appearances? |

Don't know.

Why didn't they at least make an attempt?

| | You are or were a Stephen Molyneux apologist. You've never really clarified that position. Maybe that is not relevant to this thread... |

In 2005 I saw his videos about anarchism, his delivery is very passionate they resonated with me, a few years later he became a dad and all his videos were about "anarchic parenting/love" I became uninterested and never heard anything about him after a decade when apparently he became a statis and supported Trump and had many other dumb views, thast pretty much it.

But:

| | I thought you were "Free Market" Ride or Die?

I agree with you that AOC is problematic, the hedge funds are problematic, the SEC is problematic, the corruption and cronyism is problematic, etc. I am surprised though that you are coming down so hard on the hedge funds. Ok, I get it. Elon Tusk builds great EVs and rockets. Jeff Bozos makes it simple to buy just about anything at cheap prices. Bill Ivey provides entertainment for Andy Beal, Guy Laliberte, and rando pumped up Chinese maniacs. Are they THAT much different than the hedge funds?

How would you refute my position that most or all corporations are essentially totalitarian regimes? |

Do you think the state bailing out banks who busted in 08 sound like the free market to you? There is nothing about free market in the financial sector, its a controlled market through lobbying.

If your argument is that the free market will inevitably devolve into this then my counter-argument is that socialism will inevitably devolve into the deaths of millions from starvation.

Rent seeking is a mediocre way to earn a living, and the banks are the worst renk seekers they are, which would be tolerable if they played fair, but they don't, so fuck them and comparing them to Musk is stupid.

|

|

| Ex-PokerStars Team Pro Online | |

|

|

|

whammbot Belarus. Feb 01 2021 13:57. Posts 524 | | |

| | On February 01 2021 08:51 Spitfiree wrote:

This week we're going to see a lot of people lose a lot of money that they can't afford to. Hopefully, Melvin goes down with them

How the fuck is an app like Robinhood legal in that case? |

i think you just get liquidated with what you have on the app. basically jud going busto at lightspeed

im done with stocks or trading in general. when i made a lot of money i felt my heart was going to explode lmao. when i lost a tooon of money i felt sick like being 1 outed 1000bbs deep

realized poker nor any kind of trading is not for me. with sports bets it was fine since i didnt really bet a lot but it just consumed my time watching csgo nonstop for a month lol |

|

| | Last edit: 01/02/2021 13:59 |

|

|

|

Ket  United Kingdom. Feb 01 2021 14:10. Posts 8665 United Kingdom. Feb 01 2021 14:10. Posts 8665 | | |

Sup Baal!! just to say I think you seem pretty well informed on this stuff (also how's life?!) |

|

|

|

Santafairy Korea (South). Feb 01 2021 17:34. Posts 2241 | | |

not all trades are on margin they have cash accounts also

I can't figure out definitively if buying was restricted on those as well |

|

| It seems to be not very profitable in the long run to play those kind of hands. - Gus Hansen | |

|

|

|

RiKD  United States. Feb 01 2021 22:13. Posts 9212 United States. Feb 01 2021 22:13. Posts 9212 | | |

| | On February 01 2021 08:50 Baalim wrote:

Show nested quote +

On February 01 2021 03:20 Santafairy wrote:

| | On February 01 2021 01:40 Baalim wrote:

| | On January 29 2021 09:31 Santafairy wrote:

people are trying to buy the stock at the listed value

if people are buying the stock they shouldn't need to post anything more than the stock's value in collateral, which is from actual money in the accounts of the small traders that use their service so why wouldn't they have that money right? that is an excuse... even ftp had more money on hand...

>a million people deposit $200 into FTP

>howard lederer deposits $100 million

>play $1/$2 with howard lederer

>"Due to the volatility of Howard Lederer's play, we are temporarily suspending winning pots vs him. You can only lose pots and fold your hand."

well this makes sense, if i play a pot with howard lederer ftp has to have the money after all... |

Robinhood's accounts are margin and not cash, I don't know the reason for this but these account require a Dodd-Frank mandated collateral that Robinhood did not have in their books so they were forced to close this.

I could be very well by design, or not. but the new york stock exchange along with Nasdaq were talking about closing trading the stock so, if you think me saying this somehow makes me a wallstreet apologist or something of the sort like the idiot RikD does then you'd be mistaken, I'm pretty aware that they are trying to stop the losses in very shitty ways and I'm very happy of seeing them bleed, in fact I want them to bleed much more.

|

I literally just read the opposite that half were cash accounts

But it may have been another platform |

Nope RobinHoods accounts are margin and the buy/sells are finalized 48h after, they aren't a stock exchange they are a broker but they dont execute the trades themselves, they also don't charge a fee for the trade, they make a profit by sharing the trade flow with Citadel.

Chamath Palihapitiya came down after Robinhood to promote SoFi which is owns, but it also does the exact same thing RH does with these free trades that just sell the info.

|

Damn, Wey,

I was becoming a bigger and bigger fan of Chamath but that tweet is telling. It is one thing to create something and just go about your business but it is another thing for Chamath to denigrate Facebook (and Robinhood), denigrate his work at Facebook growing the business from 20million to 1billion users, and claim that he would buy the Hamptons and convert it to homeless shelters when BTC gets to a certain number which I don't think he actually went on record to disclose AND THEN create and promote SoFi.

Maybe, it is like a JP Morgan Chase situation where internally researchers find out how serious climate change is but the executives silence it because they realize they have $800+ billion invested in fossil fuels.

Most likely, Chamath is being hypocritical and IT IS the responsibility of the (venture) capitalist to win the public relations game at any cost. If it is true that SoFi is selling retail order flow to Citadel or whoever you would think that the risk to Chamath's personal brand would perhaps not be worth it?

Hmmm, I don't know. It is an interesting development.

It is good for retail to be able to trade for free and buy fractional shares.

It is not good for hedge funds to use order flow info to front run trades or I mean really use that info for anything that hurts retail no?

So, I don't see how that business model is fair? |

|

|

|

RiKD  United States. Feb 01 2021 22:45. Posts 9212 United States. Feb 01 2021 22:45. Posts 9212 | | |

| | On February 01 2021 09:14 Baalim wrote:

Show nested quote +

On February 01 2021 03:52 RiKD wrote:

| | Apparently Robinhood blocking trading with GME was because Dodd-Frank regulations require them to post collateral since the money is settled 48h after the trades.??The collateral ammount is calculated through the greek indicators, so if a stock has a 99% of staying within certain margin they post a collateral multiplied by that 1%, but now the volume and the volatility were greatly increased so basically Robinhood would have had to post like 10% of collateral for every buy on GME by law, so they stopped the buys from it.??So it appears that this block isn't as machiavellian as it seemed before, but its still a big hit on wallstreet cred. |

If you have a source/sources for this I am perfectly happy to eat shit, etc.

|

All the investors I follow mentioned that thing about at some point, Chamath, Balajis and also the one you mentioned, Alex Wice look at their twitter for the info if you want.

Margin accounts need insurance, insurances require you to have collateral dictated by Dodd-Frank regulation, in fact also Nassim Taleb mocked the methodology (VaR) to dictate this collateral requirement.

| | Why didn't the Chairman of Interactive Brokers or the CEO of Robinhood spin that information in a positive way when they went on their big tv appearances? |

Don't know.

Why didn't they at least make an attempt?

| | You are or were a Stephen Molyneux apologist. You've never really clarified that position. Maybe that is not relevant to this thread... |

In 2005 I saw his videos about anarchism, his delivery is very passionate they resonated with me, a few years later he became a dad and all his videos were about "anarchic parenting/love" I became uninterested and never heard anything about him after a decade when apparently he became a statis and supported Trump and had many other dumb views, thast pretty much it.

But:

| | I thought you were "Free Market" Ride or Die?

I agree with you that AOC is problematic, the hedge funds are problematic, the SEC is problematic, the corruption and cronyism is problematic, etc. I am surprised though that you are coming down so hard on the hedge funds. Ok, I get it. Elon Tusk builds great EVs and rockets. Jeff Bozos makes it simple to buy just about anything at cheap prices. Bill Ivey provides entertainment for Andy Beal, Guy Laliberte, and rando pumped up Chinese maniacs. Are they THAT much different than the hedge funds?

How would you refute my position that most or all corporations are essentially totalitarian regimes? |

Do you think the state bailing out banks who busted in 08 sound like the free market to you? There is nothing about free market in the financial sector, its a controlled market through lobbying.

If your argument is that the free market will inevitably devolve into this then my counter-argument is that socialism will inevitably devolve into the deaths of millions from starvation.

Rent seeking is a mediocre way to earn a living, and the banks are the worst renk seekers they are, which would be tolerable if they played fair, but they don't, so fuck them and comparing them to Musk is stupid.

|

I was not aware of balajis. That is good to know.

In a Free Market don't hedge funds have absolute free reign to do whatever they want?

Front running, high frequency trading, collusion, etc. What do you do about that?

SpaceX, Tesla, and SolarCity all would have died with out US Government involvement. I don't believe that Peter Thiel, Bill Gates, and Warren Buffet would have formed a Super Team to save those companies. But, what if it was a Free Market and they did save those companies? Then what?

The more we promote profit to the shareholders over all else the faster we collectively charge off a cliff into the infinite abyss.

Unless, we all want to bet on a 2v2v2 BGH for the Fate of the Galaxy!

Elon Musk x Peter Thiel vs Jeff Bozos x Jamie Dimon vs Bill Gates x Warren Buffet.

Maybe, if there was no government we'd be colonizing the Moon and Mars by now mining asteroids for resources and we would not have to give two shits about Earth! The only reason to keep Earth around would be to retain customers/consumers.

We would have the most glorious Generation IV Nuclear Reactors, Fusion Power, and CO^2 Scrubbers! You wouldn't even believe how clean the Air and Water would be! You wouldn't believe how tenable our Soil would be! The Soil we risked our Blood for! |

|

|

|

hiems United States. Feb 01 2021 23:31. Posts 2979 | | |

$gme $amc continuing to dive during afterhours. |

|

| I beat Loco!!! [img]https://i.imgur.com/wkwWj2d.png[/img] | |

|

|

|

RiKD  United States. Feb 01 2021 23:41. Posts 9212 United States. Feb 01 2021 23:41. Posts 9212 | | |

I thought this was an interesting developing news story:

https://www.reddit.com/r/wallstreetbe...every_single_person_and_news_channel/

I saw that Citadel was the fifth largest investor in silver. Silver is not a r/wallstreetbets meme stock so any corporate media outlet pushing it is not to be trusted.

I remember in the past JP Morgan Chase got in trouble for fraudulently pumping silver. Obviously, they were only charged a meager fine and profited bigly so they didn't give a shit. No accountability whatsoever.

HBSC in Mexico allowed cartels to launder insane amounts. Again, they got a relatively small fine and profited bigly. I wish I could remember exact amounts and I would have to study multiple articles to find the numbers again but look into it if you are interested.

And, fucking Janet Yellen is talking shit about Crytpo when the central banking system launders trillions of dollars a year.

|

|

| | | |

|

| la belle vie the good life zui hao ming | Last edit: 12/09/2022 11:52 |

|

|

|

Baalim Mexico. Feb 02 2021 03:54. Posts 34286 | | |

| | On February 01 2021 13:10 Ket wrote:

Sup Baal!! just to say I think you seem pretty well informed on this stuff (also how's life?!) |

My man, whats up?

I was too slow to pivot to PLO as you did long ago but I pivoted early on BTC so its all good  |

|

| Ex-PokerStars Team Pro Online | |

|

|

|

Baalim Mexico. Feb 02 2021 04:03. Posts 34286 | | |

| | On February 01 2021 21:13 RiKD wrote:

Show nested quote +

On February 01 2021 08:50 Baalim wrote:

| | On February 01 2021 03:20 Santafairy wrote:

| | On February 01 2021 01:40 Baalim wrote:

| | On January 29 2021 09:31 Santafairy wrote:

people are trying to buy the stock at the listed value

if people are buying the stock they shouldn't need to post anything more than the stock's value in collateral, which is from actual money in the accounts of the small traders that use their service so why wouldn't they have that money right? that is an excuse... even ftp had more money on hand...

>a million people deposit $200 into FTP

>howard lederer deposits $100 million

>play $1/$2 with howard lederer

>"Due to the volatility of Howard Lederer's play, we are temporarily suspending winning pots vs him. You can only lose pots and fold your hand."

well this makes sense, if i play a pot with howard lederer ftp has to have the money after all... |

Robinhood's accounts are margin and not cash, I don't know the reason for this but these account require a Dodd-Frank mandated collateral that Robinhood did not have in their books so they were forced to close this.

I could be very well by design, or not. but the new york stock exchange along with Nasdaq were talking about closing trading the stock so, if you think me saying this somehow makes me a wallstreet apologist or something of the sort like the idiot RikD does then you'd be mistaken, I'm pretty aware that they are trying to stop the losses in very shitty ways and I'm very happy of seeing them bleed, in fact I want them to bleed much more.

|

I literally just read the opposite that half were cash accounts

But it may have been another platform |

Nope RobinHoods accounts are margin and the buy/sells are finalized 48h after, they aren't a stock exchange they are a broker but they dont execute the trades themselves, they also don't charge a fee for the trade, they make a profit by sharing the trade flow with Citadel.

Chamath Palihapitiya came down after Robinhood to promote SoFi which is owns, but it also does the exact same thing RH does with these free trades that just sell the info.

|

Damn, Wey,

I was becoming a bigger and bigger fan of Chamath but that tweet is telling. It is one thing to create something and just go about your business but it is another thing for Chamath to denigrate Facebook (and Robinhood), denigrate his work at Facebook growing the business from 20million to 1billion users, and claim that he would buy the Hamptons and convert it to homeless shelters when BTC gets to a certain number which I don't think he actually went on record to disclose AND THEN create and promote SoFi.

Maybe, it is like a JP Morgan Chase situation where internally researchers find out how serious climate change is but the executives silence it because they realize they have $800+ billion invested in fossil fuels.

Most likely, Chamath is being hypocritical and IT IS the responsibility of the (venture) capitalist to win the public relations game at any cost. If it is true that SoFi is selling retail order flow to Citadel or whoever you would think that the risk to Chamath's personal brand would perhaps not be worth it?

Hmmm, I don't know. It is an interesting development.

It is good for retail to be able to trade for free and buy fractional shares.

It is not good for hedge funds to use order flow info to front run trades or I mean really use that info for anything that hurts retail no?

So, I don't see how that business model is fair? |

Its not good for retail to actively trade, for the same reason why its not good for retail to play poker... its a 0 sum game against better opponents, rake or no rake won't change much for them.

Most people will lose money on this GME squeeze when the other funds and whales dump it and it goes back to its real price.

It would be good if they invested long term in companies they believe in, in which case the fees are irrelevant. |

|

| Ex-PokerStars Team Pro Online | |

|

|

|

Baalim Mexico. Feb 02 2021 04:07. Posts 34286 | | |

| | On February 01 2021 22:41 RiKD wrote:

And, fucking Janet Yellen is talking shit about Crytpo when the central banking system launders trillions of dollars a year.

|

She also seems to be a big fan of Brrrrrrrrrr... economics, so the future is looking bright for BTC. |

|

| Ex-PokerStars Team Pro Online | |

|

|

|

RiKD  United States. Feb 02 2021 04:27. Posts 9212 United States. Feb 02 2021 04:27. Posts 9212 | | |

Official Statement E-Mail Robinhood sent out an hour after the markets closed today:

A note from Robinhood

Hi RiKD,

We wanted to reach out to you after a transformative week in the markets to answer a question we know many of you are asking: “Why did Robinhood limit certain stocks?”

We understand that the temporary limits we placed on certain stocks this past week were frustrating for many, especially since we built Robinhood to expand access to investing. We have always sought to put our customers first and we want you to be able to invest on your own terms.

To help explain what happened and why we had to take action, we wrote a letter to our customers and captured the key understandings for you below:

For Robinhood to operate, we must meet clearinghouse deposit requirements to support customer trades.

Deposit requirements are determined in part by how much stock a firm’s customers hold. If a firm’s customers’ holdings are volatile, a broker (in this instance Robinhood) is obligated to meet higher deposit requirements.

Last week, in part due to volatility in some popular stocks, Robinhood’s deposit requirements rose tenfold. The combination of the deposit increase and the extraordinary increase in volume on these particular symbols led us to put temporary buying restrictions in place on a small number of those stocks.

We had to take steps to limit buying in those volatile stocks to ensure we could comfortably meet our deposit obligations. We didn’t want to stop people from buying stocks and we certainly weren’t trying to help hedge funds.

We hope you take away this: at Robinhood, we stand with everyday investors participating in the markets. Standing by our Robinhood community means being there for our customers through any trading environment. We’ll continue to improve as we break down barriers in the financial system to open it for all.

Thank you for being a part of the Robinhood community.

Sincerely,

The Robinhood Team

____________________________

"We have always sought to put our customers first"

You mean hedge funds?

"we certainly weren’t trying to help hedge funds."

Even though that is your business plan?

Business Plan:

Attract retail with rake free gambling and keep their attention with next level market leading user interface and user experience all the while selling all order flow info to Citadel, et al. IE hedge funds.

Notice they don't mention Dodd-Frank or regulation once?

My guess is that they do not want to even approach calling out the US Government, the SEC, or Wall Street. They would not dare touch them with a ten foot pole.

|

|

|

|

RiKD  United States. Feb 02 2021 05:19. Posts 9212 United States. Feb 02 2021 05:19. Posts 9212 | | |

| | On February 02 2021 03:07 Baalim wrote:

Show nested quote +

On February 01 2021 22:41 RiKD wrote:

And, fucking Janet Yellen is talking shit about Crytpo when the central banking system launders trillions of dollars a year.

|

She also seems to be a big fan of Brrrrrrrrrr... economics, so the future is looking bright for BTC.

|

My brother is an Internet nerd at heart and a PhD in Physics so no dummy but man I think the Establishment might have him.

Recently, I have been sending him stuff and bothering him. I offered to buy him a wallet, ship it to my PO box, ship it to him and send him $100 in BTC and he just doesn't show any interest. It boggles my mind.

Honestly, I think the main reason is that his wife is the biggest square of all time and would get mad at him for messing around with Crypto. I will turn them both eventually. Hopefully, before their massive 401ks are worth nothing...

My mom knows that my brother-in-law and myself have Crypto and she made some condescending comment the other night shaped by some New York Times article she read. I just shook my head and played Mario Kart 8 Deluxe but realized I was a bit tilted by the comment when I was playing like shit. Then, I had a l'esprit de l'escalier moment like 10 min. later that I should of SNAP responded, "DON'T DENIGRATE WHAT YOU DON'T UNDERSTAND!" I can't really say this to her with any effect 15 min. later so I am still simmering but then I play The Legend of Zelda: Breath of the Wild and eventually forget about it.

The point is I am all-in on BTC at this point so I forget how early we still are. My brother-in-law can be a bit of a maniac trying to trade alt-coins and he holds his money in an exchange but at least he is in the mix. I will eventually convert everyone I know or I guess they will just stay poor. |

|

| | | |

|

| la belle vie the good life zui hao ming | Last edit: 12/09/2022 11:52 |

|

|

|

Ket  United Kingdom. Feb 02 2021 12:05. Posts 8665 United Kingdom. Feb 02 2021 12:05. Posts 8665 | | |

| | On January 30 2021 20:16 locoo wrote:

It's fun watching the hypocritical posturing on both sides as the hedge fund guys try to say they’re the victims, and the yolo WSB crowd out to try to game the system for a buck try to justify stock manipulation as a rebellious act. All while being used to advance the agenda of opportunistic and scary political figures like AOC and her "tax the rich" (I think she means eat the rich) mantra. Anyway made a few bucks on AMC so keep the fight going. I'll keep buying support and selling into strenght.

Also if you haven't you should watch both the Webull CEO and the Robinhood CEO (co founder?) talking about the issue. It's obvious the latter is fucked and is trying to minimize losses by lying, seeing how the former is being so much more open about what really happened. |

sup locoo hope all is well with family.. great post and agree 100%, going to be a real unpopular take on the interwebs but there is plenty of claimed nobility and zero actual nobility on either side. we're wired for fomo and crowd behaviour.. see a stock chart going parabolic, reddit meme bros piling in, a compelling "stick it to the man, they'll have to cover shorts at any price" narrative and that's a powerfomo irresistible cocktail to pile in right behind and add further fuel which in turn gets more fomo redditors in. ofcourse the real motivation is greed and fomo. Nothing wrong with those things and i like participating in zero sum socially unproductive games with money as much as the next guy but let's not kid ourselves into legitimising all this as some kind of occupy wall st social protest.

ha good observation on the opportunism of politicians hijacking the bandwagon of the day to advance the pet cause.. eat the rich indeed |

|

|

|

Spitfiree Bulgaria. Feb 02 2021 12:42. Posts 9634 | | |

I'd feel same holding money in certain exchanges e.g. bitstamp is EU regulated.

You have to know that probably 90%+ of people don't even know how money is issued in the current system they are living in.... imagine their knowledge about crypto |

|

|

|

hiems United States. Feb 02 2021 14:29. Posts 2979 | | |

| | On February 02 2021 04:19 RiKD wrote:

Show nested quote +

On February 02 2021 03:07 Baalim wrote:

| | On February 01 2021 22:41 RiKD wrote:

And, fucking Janet Yellen is talking shit about Crytpo when the central banking system launders trillions of dollars a year.

|

She also seems to be a big fan of Brrrrrrrrrr... economics, so the future is looking bright for BTC.

|

My brother is an Internet nerd at heart and a PhD in Physics so no dummy but man I think the Establishment might have him.

Recently, I have been sending him stuff and bothering him. I offered to buy him a wallet, ship it to my PO box, ship it to him and send him $100 in BTC and he just doesn't show any interest. It boggles my mind.

Honestly, I think the main reason is that his wife is the biggest square of all time and would get mad at him for messing around with Crypto. I will turn them both eventually. Hopefully, before their massive 401ks are worth nothing...

My mom knows that my brother-in-law and myself have Crypto and she made some condescending comment the other night shaped by some New York Times article she read. I just shook my head and played Mario Kart 8 Deluxe but realized I was a bit tilted by the comment when I was playing like shit. Then, I had a l'esprit de l'escalier moment like 10 min. later that I should of SNAP responded, "DON'T DENIGRATE WHAT YOU DON'T UNDERSTAND!" I can't really say this to her with any effect 15 min. later so I am still simmering but then I play The Legend of Zelda: Breath of the Wild and eventually forget about it.

The point is I am all-in on BTC at this point so I forget how early we still are. My brother-in-law can be a bit of a maniac trying to trade alt-coins and he holds his money in an exchange but at least he is in the mix. I will eventually convert everyone I know or I guess they will just stay poor. |

why do u have a po box |

|

| I beat Loco!!! [img]https://i.imgur.com/wkwWj2d.png[/img] | |

|

| |

|

|

Poker Streams | |

|

Contact Users: 463 Active, 0 Logged in - Time: 14:07

Contact Users: 463 Active, 0 Logged in - Time: 14:07